Zerohedge 03/29/2019

Zerohedge 03/29/2019

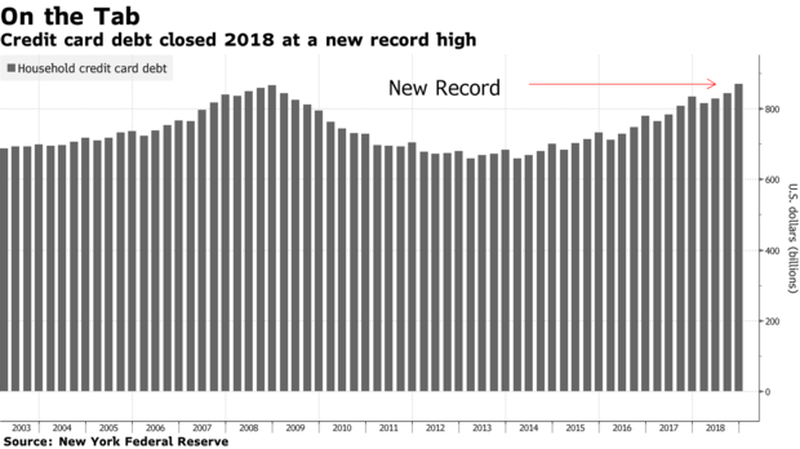

Zerohedge readers who follow our monthly consumer credit updates already knew, aggregate household debt balances jumped in 4Q18. As of late December, total household indebtedness was at a staggering $13.54 trillion, $32 billion higher than 3Q18.

More troubling is that 37 million Americans had a 90-day delinquent strike added to their credit report last quarter,

an increase of two million from the fourth quarter of 2017. These 37

million delinquent accounts held roughly $68 billion in debt, or roughly

the market cap of BlackRock, Inc.

* * *

New evidence this week points to a further deterioration in consumer creditworthiness.

To understand the American credit card debt crisis, real estate data company Clever surveyed 1,000 credit card users earlier this month.

Using Consumer Financial Protection credit card complaint data and

other forms of consumer metrics, the company was able to gain tremendous

insight into the average American’s purchasing habits, dependence on

credit cards, and feelings about their debt situation.

The survey found that 47% of Americans have a monthly balance on

their credit card. About 30% of respondents with credit card debt

believe they'll extinguish the debt this year, leading many of the

respondents stuck in an endless debt cycle.

Fifty-six percent of the respondents say they've had credit card debt

for more than a year. About 20% estimate their debt will be paid off by

2022, while 8% were unsure about a timeline.

“It’s a big issue,” Ted Rossman, credit industry expert for CreditCards.com, tells CNBC.

With credit card APR soaring to about 17.64%, a new high, the interest

accrued on monthly balances can quickly add up and trap unsuspecting

consumers with insurmountable debt.

No comments:

Post a Comment