The Register6 Jan 2021

The US Treasury Department's Office of the Comptroller of the Currency (OCC) on Monday published a letter clarifying how federally chartered banking groups can use cryptocurrency and associated technology to manage financial transactions.

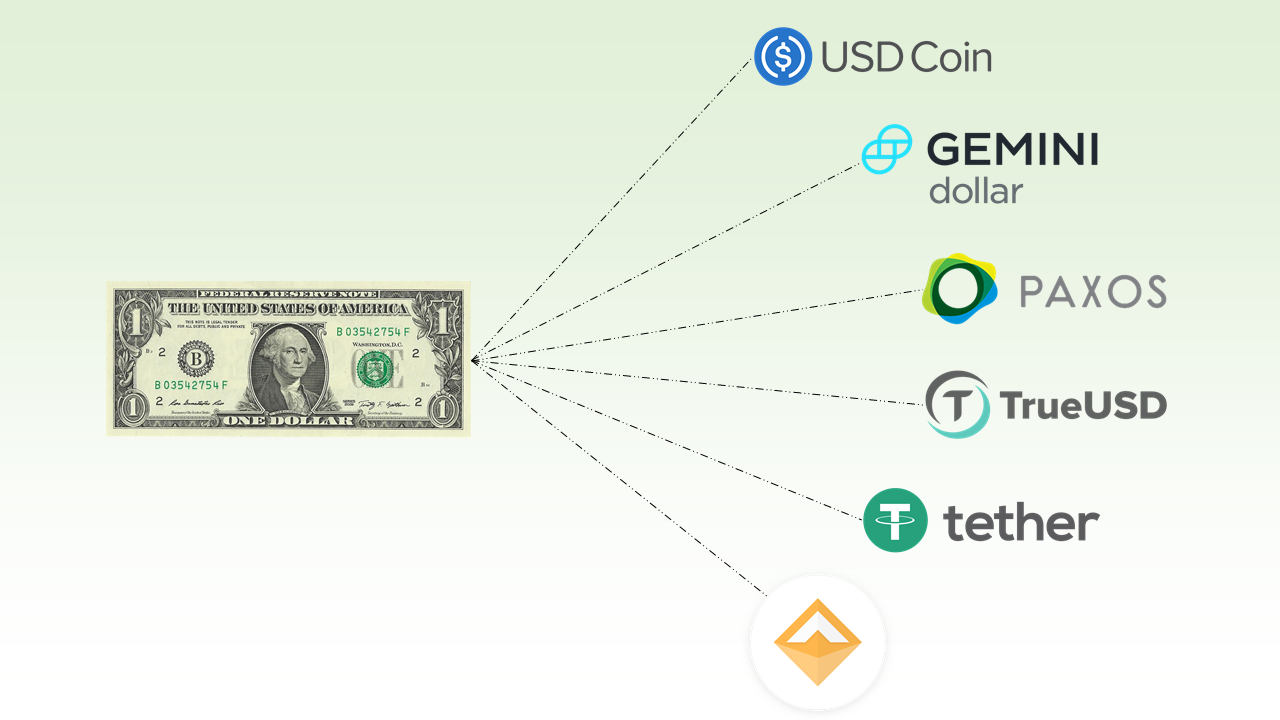

The letter endorses the use of independent node verification networks (INVN), such as blockchain distributed ledgers, and stablecoins – cryptocurrencies tied to fiat currencies, like Ethereum-based USD Coin (USDC) – as a means to settle customer transactions.

"Our letter removes any legal uncertainty about the authority of banks to connect to blockchains as validator nodes and thereby transact stablecoin payments on behalf of customers who are increasingly demanding the speed, efficiency, interoperability, and low cost associated with these products," said Acting Comptroller of the Currency Brian Brooks in a statement.

The agency letter blesses the use of independent node verification network (INVN) systems to validate, store, and record payment transactions, and lets banks use INVNs and associated stablecoins (those pegged to a physical currency) for other lawful payments, per existing banking laws.

In an email to The Register, David Yermack, a professor of finance at the New York University Stern School of Business and adjunct professor of law at New York University School of Law, said that this looks like a big deal.

"It indirectly encourages banks to explore using FinTech platforms, and it seems to open the door for them to transact in instruments such as Tether, Diem (Libra), and other so-called stablecoins that are pegged to the US dollar," said Yermack.

No comments:

Post a Comment